Quick Links

Quick Links

As a freelancer you wear many hats, whether you want to or not. And one of the most challenging roles you may face is handling all your accounting as an independent contractor.

Many freelancers see their work as an art form and struggle with more ordinary tasks such as billing, paying taxes, signing contracts, and managing business expenses. But it’s important to periodically set aside the artistic or creative side and step into your role as a business person and bookkeeper to ensure your business finances are in order.

Luckily, there are a variety of tools and tips available to help you through the more mundane parts of being a freelancer, so you can spend less time balancing the books — and more time working on your craft.

Here are some of the most important aspects of freelancer accounting and how you can set yourself up for success.

Establishing Your Freelancing Business Properly

When you first get started as a freelancer, working as a sole proprietor is perfectly fine. But as your freelancing business grows, you should consider separating your personal spending and assets from your business-related ones.

Separating your personal and business assets can offer you some protection if you’re sued as a freelancer. For example, a writer is sometimes required to sign a confidentiality or non-compete contract. The writer may be sued for violating the rules of the contract, intentionally or not.

If your expenses and assets are intermingled, you (and not your business) will be liable. Setting up your freelance building as a limited liability corporation (LLC) or S-corporation could provide you with some protections.

Once you establish your freelance business as its own entity, you’ll need to file and pay personal and company taxes. It may be extra work and more expensive, but if your freelance business is growing, having a professional presence is essential. Some steps you can take to separate your business from your personal life:

- Apply for an Employer ID Number (EIN) with the IRS to use instead of your Social Security number

- Open a business bank account

- Create a PayPal business account

- Apply for a corporate or business credit card

Business credit cards and bank accounts will use your personal credit score until you establish enough business credit, so make sure your credit history is good enough to qualify. And once you’re approved for a credit card, remember to spend and pay responsibly — any late payments or delinquencies will negatively affect your personal credit score.

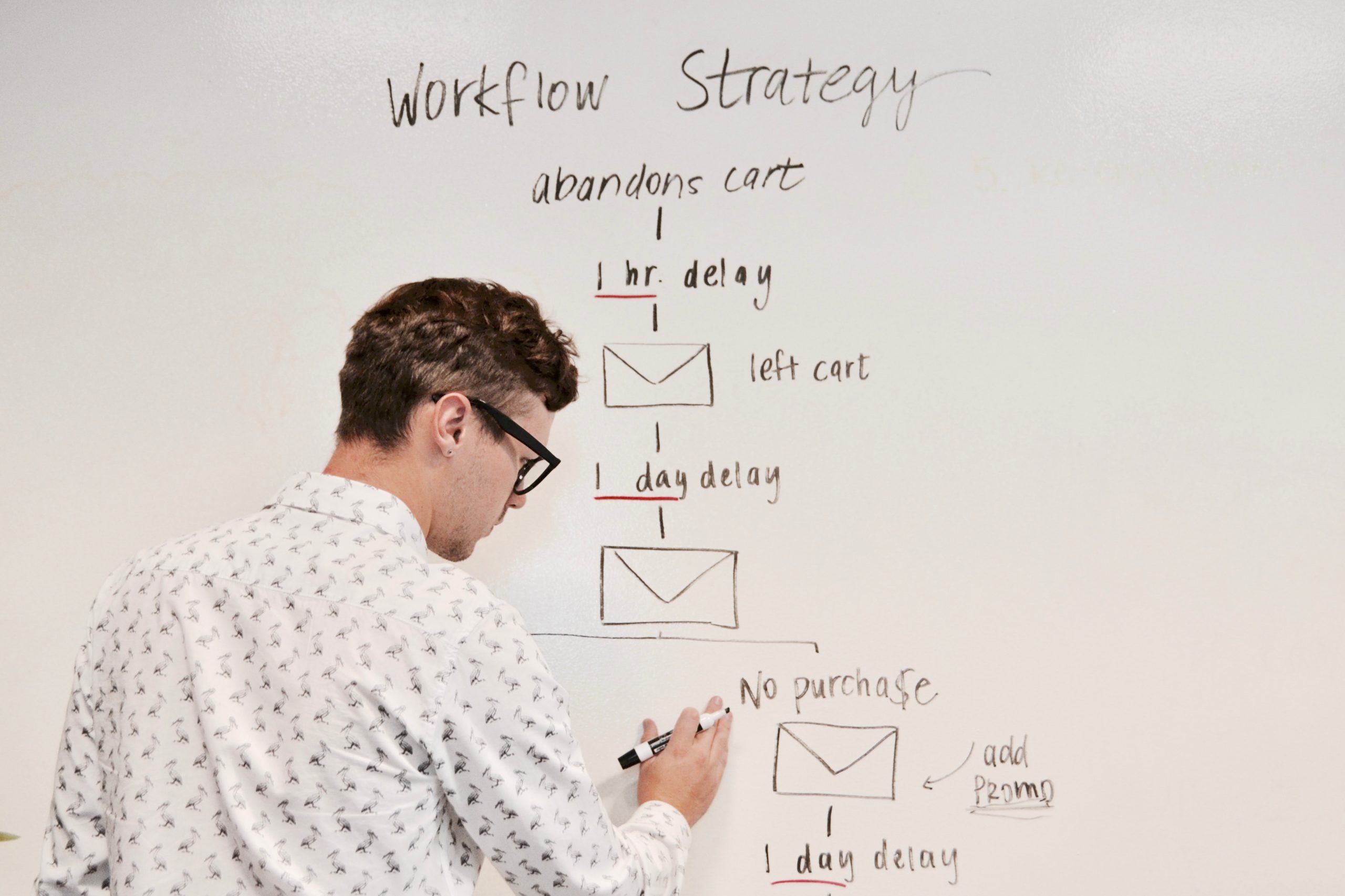

Setting up a Workflow for Assignments

Keeping track of your work is essential. Some freelancers have more than one gig and need a way to keep track of all the side hustles. And as your freelance business grows beyond a couple of clients, having an organized system will help you reduce any errors, such as missing a deadline or forgetting to bill a client for the work you’ve invested. You’ll want to create a workflow system for a variety of reasons:

- Review your upcoming workday or week

- Have an overview of your deadlines

- Track the hours you’re putting into a project

- Assign tasks and to your support team and track their progress

- Have a good idea about your upcoming availability

There are plenty of good workflow tools you can use to manage your work. Some of them work as digital boards where you can pin cards on the columns you create. You can move cards from one column to another as you complete assignments so that you can see your progress quickly. You can use these boards for your content calendars and their lists to track task completion. Others provide customized spreadsheets and workspaces for contact tracking.

Automating the Billing Process

Billing promptly is essential if you want to get paid. The process may be tedious, but you can choose an app to automate the billing process. An app will not only save you time on billing — the output will look professional. Consider a free invoicing app to handle most of the process on your behalf.

You’ll be able to customize your invoice by editing the colors, adding a logo, and changing the wording on the invoice. Either app accepts credit card payments straight from the invoice to encourage clients to pay on the spot.

To ensure you get paid quickly, consider providing more than one payment option such as a credit card payment, electronic transfer (EFT), and Paypal. If you’re using an invoicing app, make sure to enable payment reminders for yourself and the client, so you’re aware of any delays in getting paid and you can address them with the client right away.

Once you get the hang of the invoicing software or app, consider expanding into using all of the additional accounting features for a fully integrated accounting experience. You may have to pay a fee to unlock all the features, but you’ll have access to time tracking, expense management, bank and credit card reconciliation, and more. Most importantly, accounting and invoicing software comes with encryption and other security to protect your most sensitive financial information.

The small investment may be worth the money — you’ll save time by handling the needs of your freelance business all in one place and reduce the chances of tax-filing errors.

Paying Bills and Tracking Expenses

Depending on the size of your freelancing business, you may have just a small handful of bills — or many. If you have good financial habits and regularly pay your bills on time, consider paying for most of your expenses with your company credit card.

Paying your expenses with a company card can help you when it’s time to pay taxes because most business cards will send out a detailed annual spending report so you can quickly review your company’s annual spending by category in one place. The annual spending report can save you hours of having to sort and tally receipts to file your taxes.

Plus, if your business card is a rewards credit card, you can earn bonus points for all your spending, which can be used for free travel or to redeem as cash. The key to managing your bills with a company credit card is to always pay your card balance off in full and on time. Otherwise, the finance charges and late payment fees will offset any rewards you may earn from your spending.

If paying your business expenses with a credit card isn’t feasible, the easiest way to pay your bills is to set up auto payments for your recurring bills and scheduling the rest electronically, so that you can have a record of your payments. Plus, if you use accounting software, electronic transactions will automatically transfer into your software’s ledger for easier tracking.

Keeping Track of Your Income

A freelancer with several clients may receive payment in different ways. Regardless of how you’re paid, you’ll need to keep track of your payments for tax time.

Businesses are required to send you a 1099 listing how much they paid you for the year. But if you earned less than $400, they don’t have to send you one. This doesn’t mean you can skip reporting the income if you don’t receive a 1099. You should still report the amount you earned, even if you didn’t receive a 1099. Better safe than sorry — if you don’t accurately report your earnings when you file, you may have to deal with an unpleasant audit by the IRS down the road to explain why.

To track your client payments, you can simply list all of your payments on a sheet as they come in. Or if you have invoicing software, it will keep track of your payments. All you’ll need to do is generate a report when you’re ready.

Filing Your Taxes

Freelance taxes are a daunting part of the accounting process. Freelancers are responsible for paying their own self-employment taxes, which is currently 15.3%, to cover your Social Security benefits and Medicare. Plus, you’re still responsible for income tax. To avoid the shock of how much you owe when you file your freelance taxes, get into the habit of setting aside 25% of every paid invoice to cover your income tax liability.

Depending on how much you paid in taxes in previous years, you may have to prepay your taxes on a quarterly basis. According to the IRS, you’ll need to pay estimated taxes if you owe $1,000 or more on April 15, June 15, September 15, and January 15. For example, if you paid $1,600 in taxes last year and you expect your business to continue at the same pace, you should prepay the estimated amount of $400 in June, September, January, and April. The good news is, by the time you file and submit your taxes in April, most of your tax bill has been paid.

You may want to invest in tax filing software to help you with the complex task of prepaying and filing your taxes. Improperly filing or forgetting to file your taxes on time can cost you. The self-employed edition of TurboTax currently costs $120, but the software takes the guesswork out of many of the most complicated aspects.

Simplified Accounting for Freelancers

There are many aspects to accounting when you’re a freelancer. Make use of software and apps to help you automate the process. Software or apps can help you with portions of the accounting process you may not have experience with, plus help you reduce any errors from manually entering hours of data. The more automated your accounting system is, the more time you’ll save to focus on your task.

Do you still have questions on how to handle taxes and other things regarding your income as a freelancer? You may want to consider hiring an accountant to ensure all of your finances are documented properly.