Quick Links

Quick Links

“…business is no more about making money than the human body is about making blood. Yes, the human body needs blood.”

– Phil Knight, Founder of Nike, Shoe Dog

Cash is a means to an end, not an end in itself. But, yes, cash is necessary. It is the means to accomplish the vision you created your business to achieve.

This may seem obvious, but after studying and working with 100’s of businesses over the last few years, we’ve seen an unreasonable number of entrepreneurs fail at eCommerce cash management. The business’s fate is common: fail, get stuck, or get very lucky.

What is eCommerce cash management?

- understanding how every action impacts the actual bank account, and

- building rhythms in the business to monitor and improve cash flow drivers.

Since founders don’t start businesses to conduct Wednesday morning cash management meetings or build cash flow forecasts, cash flow may only get attention when an emergency arises. It’s no wonder that 50% of businesses close their doors within 5 years and about two-thirds within 10 years.

To help you focus on what you enjoy most (probably not cash management), we put together four tips for managing cash that will help you harness the growth potential of your eCommerce business and give you more confidence in your decision-making.

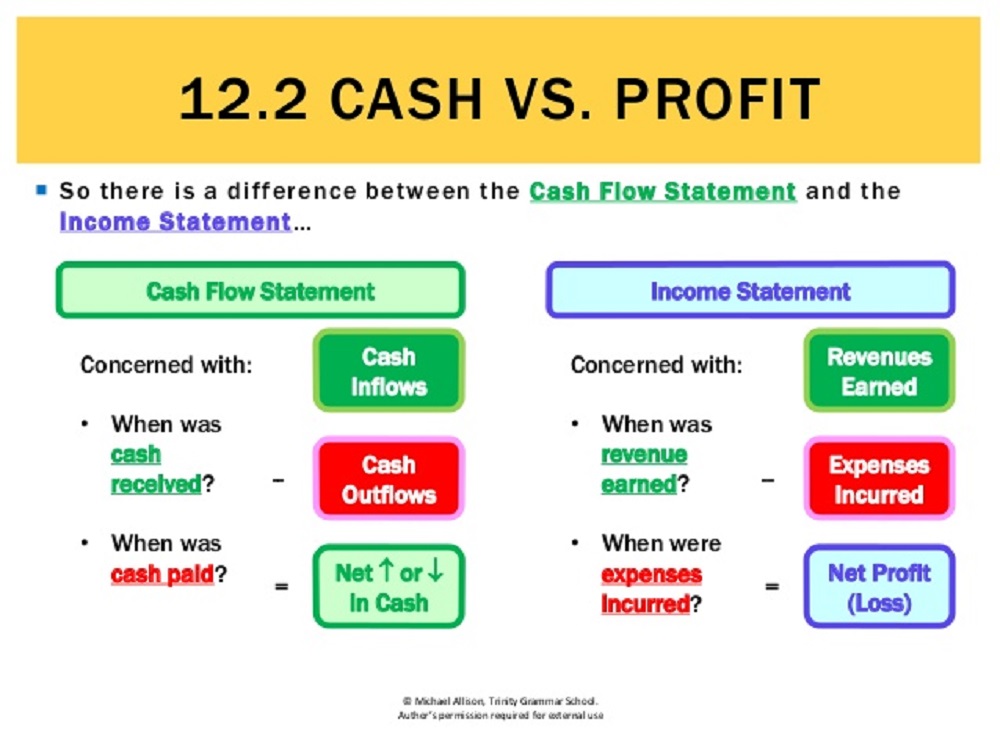

(1) Net Income is NOT Cash Flow

Business owners need more than profit and loss to understand whether the bank account will increase. Timing is everything. Many different factors compete for resources within your business and they don’t organize themselves in the way most profit and loss calculations would have you believe.

From inventory ordering, to payroll timing, to your terms with your manufacturer, each factor has a cadence that is not necessarily reflected in a monthly profit and loss statement.

A classic example is stocking up for the holiday season. You order far more goods than you plan to sell in October and put yourself at risk of overstocking and injuring the bank account. A more nuanced example is the cash cycle that happens within a month. These higher frequency fluctuations can put a thriving business in peril quickly.

Mapping each expense daily for each month is likely too large an undertaking. So, at minimum, map out when the 5-10 biggest ongoing expenses are expected to hit over the next 30 days. This is an 80/20 solution for the busy business owner.

(2) Forecast using Unit Economics (not arbitrary percentages)

Unit economics is just a fancy term that means a calculation of the amount of cash each unit sold contributes to overhead costs. In order to understand cash flow in the future, you must spell out the relationship between each unit sold and all the actions required to generate and support that sale.

Each of these actions has a cost and timing. Some of these costs are variable (only occur upon purchase), others fixed (occur regardless of purchase), and some “chunky” (only occur during a certain project). This exercise helps you know the cash impact of promoting or producing a particular product over others, and helps you test to see what the most profitable sales mix might be.

(3) Know your Cash ROAS (CROAS)

Return on Advertising Spend (ROAS) is not enough to measure profitability of advertising efforts. CROAS is calculated by measuring ROAS after incurring all variable costs required to make the product. These costs typically include: production, variable labor, shipping, transaction fees, Amazon fees, Shopify fees, agency fees, customer acquisition costs (among others).

When you are setting a target ROAS, be sure to include all your variable costs, and the fixed costs of the agency. Many entrepreneurs mysteriously lose cash because they increase ad spend based on a ROAS target too low for their business. Sales go up, bank account goes down. And conversely, many businesses aren’t growing sales enough, because they think their ROAS must be higher. All this confusion can be wiped away by calculating your CROAS.

(4) Improve Inventory Management for Growth’s Sake

Managing inventory in growth is very different than in stable revenue.

When a company is looking to grow faster than they have ever before, the past is obviously no longer a good predictor of the future. Nonetheless, many business owners still use the past as the primary indicator of how much inventory they should order. Usually this takes the form of an arbitrary growth rate applied to last year’s sales.

Build sales forecasts based on real actions you will take to drive sales, then make assumptions only where needed. For instance, instead of assuming a percentage growth on overall sales, calculate your revenue projections this way:

- Choose your ad spend budget,

- Assume a customer acquisition cost and an average order value in each advertising channel,

- Calculate ad-driven revenue per channel — even if you do a lot of content or brand marketing

- Assume what percentage of sales will be purely organic, and

- Add it all together.

Once you put together this forecast, remember that no one can accurately predict the future, but you can narrow the region of darkness.

Finally, compare those forecasts to the recent past and to your gut. Your inventory process is far more likely to be more precise when your assumptions become more precise. When inventory is more precise, the bank account is happy.

To Better eCommerce Cash Management

The complexity of a business’s numbers can hardly be summed up in four tips. But, if you execute on these four, you will see dramatic improvements, and you will get a big step closer to knowing how your decisions today will impact the bank account tomorrow.