Quick Links

Quick Links

The importance of keyword research for Amazon sellers cannot be overstated.

However, when tackling the tall task of completing keyword research, it’s important to start from a ‘top-down’ perspective. This is true for brand-new beginner sellers and enterprise-level brands and accounts alike.

To simplify this process, I’ll share what I view to be the most important rules to get you started on your expert-level keyword journey.

Let’s call these the 3 rules of expert-level keyword research.

Rule #1: Put a disproportionate focus on Amazon data.

Late last year, Amazon effectively closed the ‘loophole’ that allowed a few platforms to display real Amazon search volume. This once-available data was immensely insightful to inform sellers of the demand for keywords as well as the ability to analyze trends utilizing real Amazon data (updated daily via the top platforms).

Sellers were right in prioritizing and, to a degree, putting such data on a pedestal. However, as you can imagine, the availability (or lack thereof) of this data did not impact the power and utility of Amazon data on an ongoing basis. It simply stands above the rest.

In truth, this major update has created a unique vacuum. As part of the Seller.Tools team, I was acutely aware of the opportunity we had to fill the need with more Amazon data (both exclusive data points and others that are readily available) to meet the demand of top-level sellers who rightly always want to stay a step ahead.

The surprising addition of Brand Analytics data accessibility made available to select Seller Central accounts and the means of capturing Amazon data for expert-level keyword research becomes more nuanced.

The major takeaway here is ensuring Amazon data is at the foundation of your keyword research. The alternatives pale in comparison in their utility to the point of being misleading and potentially catastrophic. There’s nothing worse than prioritizing irrelevant, saturated and low-impact keywords.

Rule #2: You always want MORE keywords on your radar.

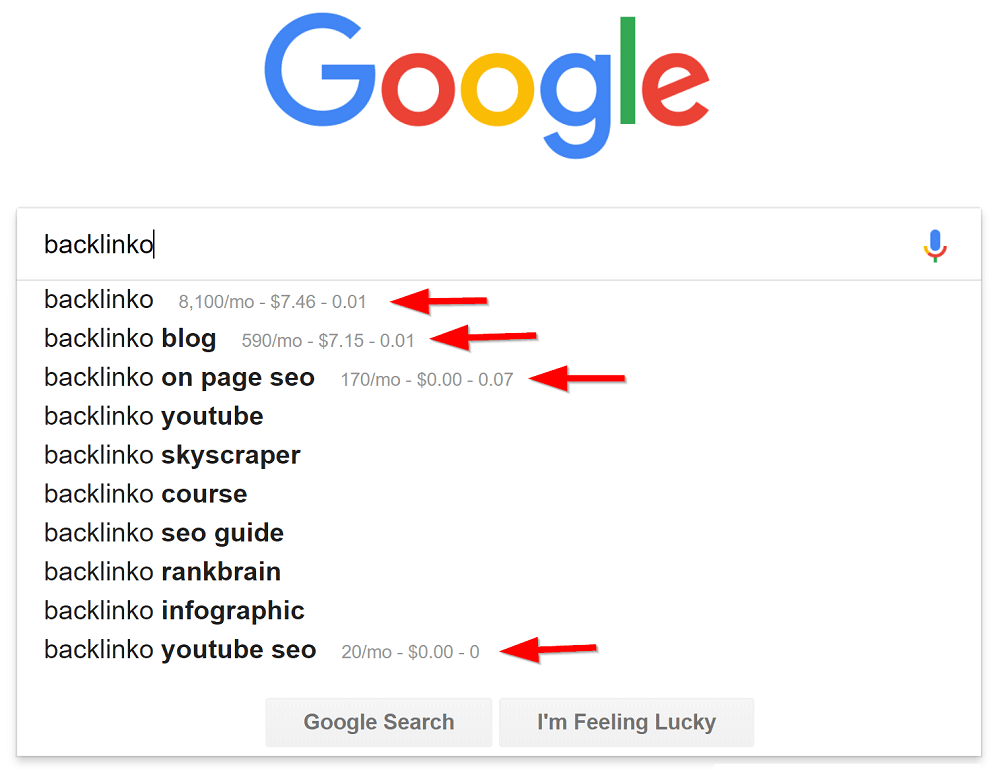

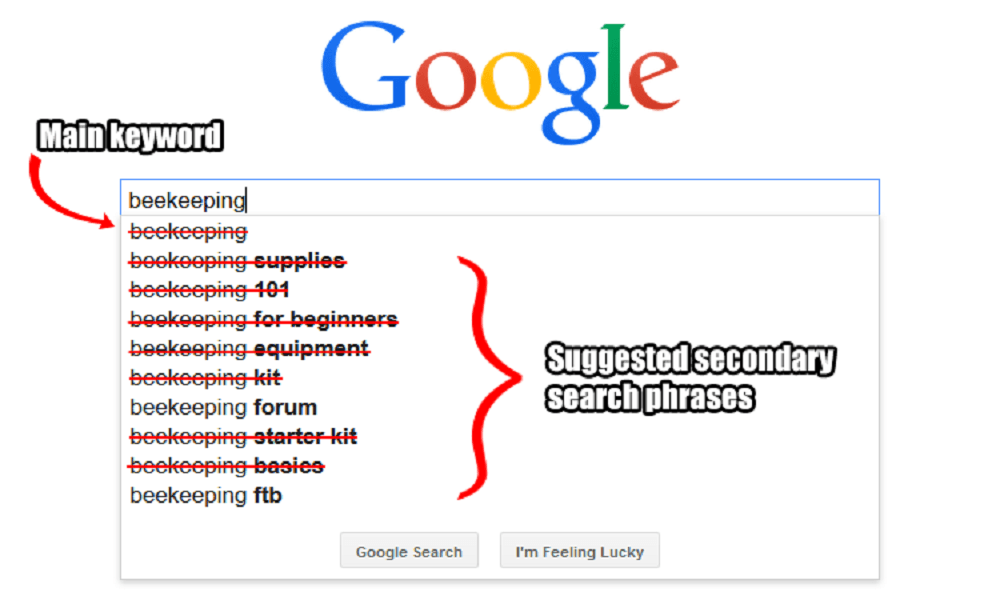

The wider the funnel of inputs you have, the greater level of insights you’ll receive. Variety (keeping Rule #1 in mind) is ideal as well. There’s an abundance of ways Amazon provides data, and it’s crucial for the savvy seller to welcome as many of them as possible.

There are implications from both a paid and organic perspective. With Amazon PPC, you can continuously harvest keywords from auto campaigns on an ongoing basis. These are paid insights that are definitely worth capturing and leveraging.

From an organic perspective, it’s intuitive to use a Reverse ASIN-type search on top-performing competitors to grab the keywords they are ranking for. While this is not explicitly ‘Amazon data’, it’s an input worth leveraging as it operates off the assumption that highly visible competitors and their associated keywords are worth prioritizing.

Ultimately, the analogy of a funnel here is quite fitting. Welcome as much keyword data as possible and ideally, you’d leverage a tool or resource to help define prioritization understanding key considerations such as the weighting of listing elements (ex: Title vs Description).

Rule #3: It’s ideal to have some amount of performance insight into how well you are performing at the keyword level.

The emphasis here would be on organic performance as pay to play insights can be derived from PPC reports and metrics. In truth, I’m showing my own hand a bit here, as Seller.Tools leverages an Amazon datapoint to provide exactly what we are looking for here – keyword performance (via Pulse).

However, what’s important is that you have some indication of keyword performance to inform optimization decisions.

It should be noted that at a base or foundational level you at least want to have visibility into your keywords’ index statuses. Without indexation, your product could very well not show up in search results for a given keyword – essentially a wasted opportunity. Index visibility is the de facto starting place and it’s strongly encouraged that you have automatic visibility, as manual and infrequent checks fly in the face of the importance of your products’ visibility for given keywords.

In short, follow these three rules:

- Ensure frequent, automatic index visibility

- Graduate to keyword performance insights as quickly as possible

- Use the best possible data (Amazon data) to drive your decision-making

Now, with these rules in hand, you’ll be leaps and bounds ahead of the pack for visibility on Amazon. Misinformation abounds in this space, but the practical application of these rules will ensure you can cut through even the toughest of markets.