Quick Links

Quick Links

The most important segment of starting a new business is the financial aspect of the project. If you decided to take the leap and launch your own startup business, you will need startup funding resources to cover administrative costs and the basic capital needed for day-to-day operations.

Keep reading to learn about the best 5 financing options to get your startup business off the ground.

Government Grants

If your startup project is specialized in the field of technology, there’s a decent possibility that you can land financing from one of your government funds. This is especially applicable if you live in the European Union. The EU is trying to catch up with the USA and Japan in innovation, and their first line of action is supplying grants for startups.

At the same time, tech startups are also interesting to investors because of a higher earning potential. So, before you start your company, think about whether you have the potential to deal with technology and development.

Before you apply for a government grant, carefully examine and go through the requirements and application procedures for each program you are interested in. In most cases, denied applications for startup government grants are due to the non-fulfillment of the basic requirements. To save time, make sure you check all the boxes before you even start writing an application.

If you want to find project writers who can craft the proposal for you, you can use some of the following online services: BestEssayEducation (a database of professional writers), WowGrade> (to find experts on any topic, including proposal writing), BusinessTown (a collection of templates for startup financing proposals), SupremeDissertations (use academic writers and experts to write your financing proposal).

Bootstrapping

In simple terms, bootstrapping implies launching a startup company using personal funds exclusively. If you decide to go with this type of financing, you will have to find methods that will help you to avoid using external capital. This method can work if you are extremely creative and resourceful and you continuously work on reducing your expenses.

In this regard, here are some of the most important saving and budgeting tips for startups:

- Hire Freelancers Instead of Employees – committing to a full-time wage to one or more employees will put unnecessary strain on your new business; instead, work with independent professionals on a per-project basis

- Work Remotely or in a Mobile Office – instead of signing a long-term contract on an office space, work remotely or in a mobile location, at least in the initial periods

- Bring Your Own Device (BYOD) – encourage your contractors/freelancers to bring their own devices to work; you should also consider leasing equipment

- Plan and Budget – if you precisely outline a budget and stick to it, it will be much easier to have and maintain control over your startup’s finances

- Consider Coworking Spaces or renting out a desk in your local entrepreneurship incubator

The biggest advantage of this financing model is the degree of control over the company’s growth, which is desirable if you already have entrepreneurial experience and you have a wide business contact network.

At the same time, it’s important to note that bootstrapping is possible only when you’re covering smaller initial costs, i.e. the amount you’re able to cover yourself.

If you decide to go with the bootstrapping option, it’s very important that you start turning a profit from the very start. In other words, you need to have the possibility of running a company sustainably without any outside investments.

Informal Investors (Angels)

Non-institutional investors, also known as business angels, are individuals who possess a redundancy of financial funds, relevant knowledge in a particular field of business, and/or managerial experience.

Angels are most often persons who operated successfully in a particular business field or industry, so they are using the capital and knowledge they have acquired to invest in startups they find promising and interesting.

If you decide to contact a non-formal investor with a proposition for business cooperation, it’s good to keep in mind that there are several types of business angels:

Operational Angels

These are investors that have a work history in the same branch of business as the startups they are looking to finance. The drawback is that they usually have a history of working in big corporations, so they lack the knowledge of working with small and medium enterprises.

Financial Angels

This group of investors takes part in a startup business project only through a financial investment, with the goal of achieving a return on investment.

Angels Entrepreneurs

These are ex-entrepreneurs with a track record of success. Unlike the so-called operational angels, they don’t necessarily have a history of working in the same branch as the startups they invest in.

All-in-one Angels

There are business angels that have been working as successful entrepreneurs in the same business field as the startups they invest in, in firms of similar size.

Enthusiast Angels

Finally, there are groups of investors that invest smaller amounts in several companies, even without direct ties to them. Usually, they don’t meddle in the operations or management whatsoever.

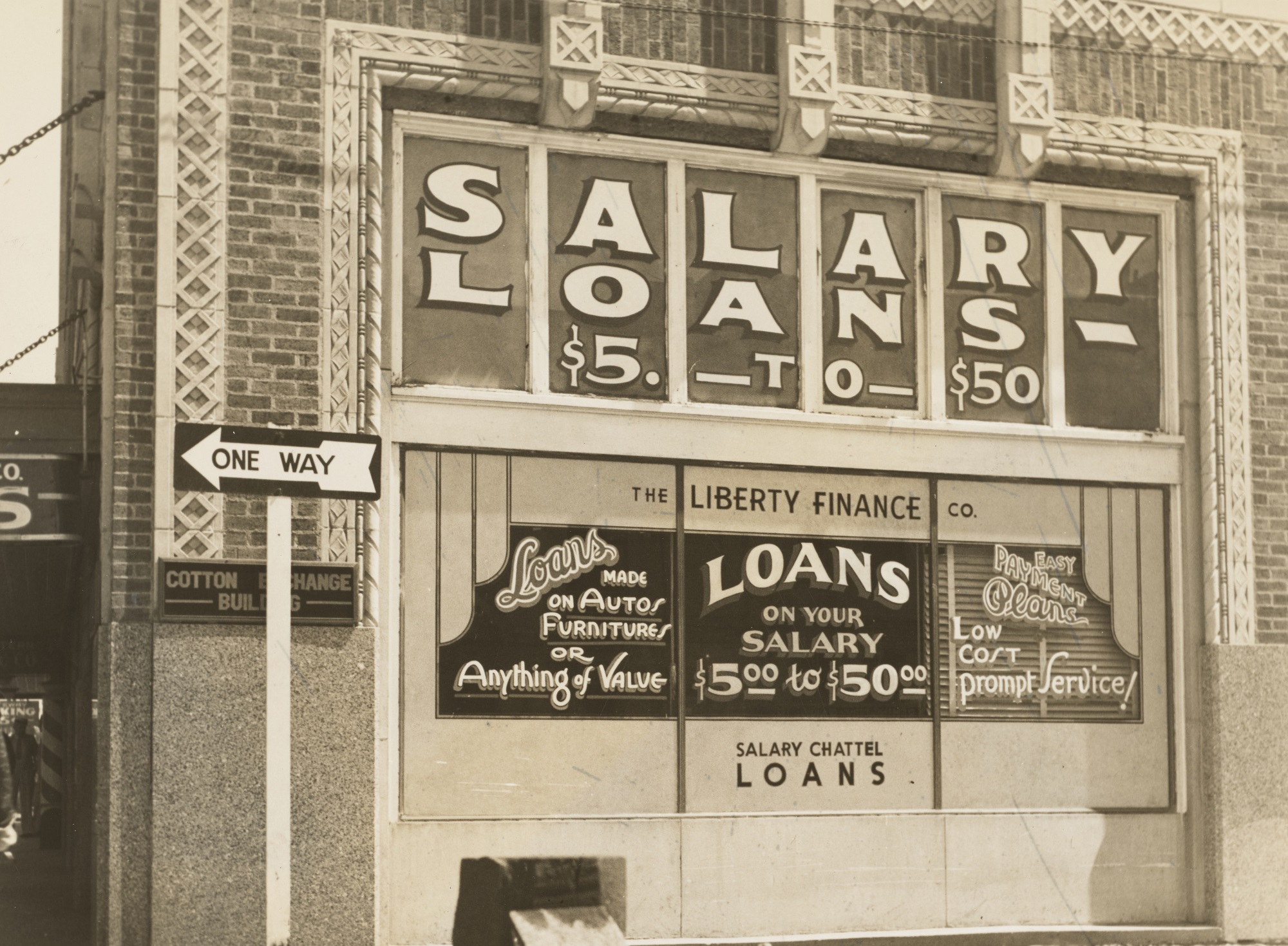

Bank Loans

Business loans are one of the most prominent banking services. When it comes to financing projects in the field of small to medium entrepreneurship ventures, bank loans are the most common way to get financing quickly.

Generally, bank loans are divided according to different criteria, such as purpose, source, maturity date, etc. According to the course of repayment, bank loans feature short-term, mid-term and long-term loans.

If you decide to finance your startup project with a bank loan, you should work on crafting a high-quality business plan. This document will not only show you and potential investors what you’re doing and how you want to make it happen, but it’s also an important part of the documentation banks require in their risk assessment procedures. The quality of the business plan and business feasibility will have a strong influence over the final decision whether to approve the loan or not.

FFF – I Get By With a Little Help From My Friends

FFF stands for friends, family and fools – usually, it symbolizes first investors you can count on in the earliest stages of your startup, i.e. in the phase when you still don’t achieve positive business results.

The advantage of FFF financing is the fact that, in most cases, you’ll be able to talk your close friends and family into investing in your startup quite easily. It’s even likely that some of your FFF investors will be your first client or customer.

However, keep in mind that this type of financing can have severe downsides – mixing family and friendship with business usually doesn’t end well.

Conclusion

If you feel like finances are dragging you down and preventing you from achieving your dreams, you just have to stay informed about all the possibilities for startup financing.

Depending on your business needs and expectations, compare the pros and cons of the financing modes we have outlined above and choose according to your goals. If you’re looking for more information on how to build a successful startup, check out these tips.

Thanks